MONDAY, AUGUST 10, 2015

The Florida property insurance market is looking good these days, thanks to 10 years without a major hurricane event. Will 2015 be the year that changes?

A.M. Best asks that question in the title of its latest report on the property insurance market in Florida. "Florida Property Insurers Remain Untested: Will 2015 Be the Year?" takes a look at how marketshare has shifted to and away from Citizens Property Casualty Insurance Corp. and back to private insurers in the past 10 years.

After the severely damaging hurricanes that struck Florida in 2004 and 2005, many insurance companies began to pull out of the state in order to reduce or elminate hurricane exposures from their books of business. Hurricanes, along with sinkholes, escalating reinsurance costs and general market conditions, caused many leading carriers in the marketplace to reduce Florida property exposures.

What followed was many homeowners taking out policies with Citizens, the state's insurer of last resort. When Citizens was created in 2002 by the Florida Legislature to provide policyholders another choice for their property insurance, it had approximately 600,000 policies in force. After the 2004-2005 hurricane events, policy counts increased significantly to over 1.5 million policies written, or 26% of the entire Florida residential property insurance market.

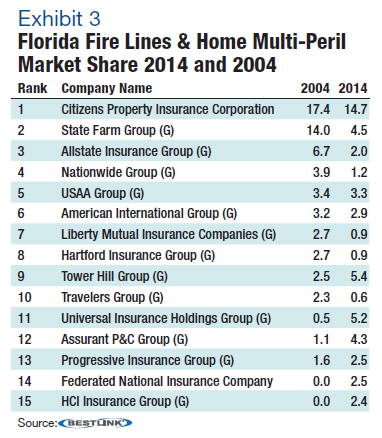

(See the chart below showing market share comparisons for 2004 and 2014.)

After taking up so much of the market share for 11 years, Citizens finally began to take steps to depopulate in 2013. Legislation required Citizens to create programs to return its policyholders to the private insurance market. The efforts have been effective, with policy counts returning to around 600,000 by early this year.

This, coupled with a lack of significant weather events in the past ten years and favorable reinsurance market conditions, makes Florida an attractive market for private insurance carriers right now. Some of today's biggest players in the marketplace are smaller newly formed or local Florida-only property writers.

These companies have experienced significant growth thanks to Citizens' takeout efforts. And conditions have been extremely favorable for reinsurers as well because of Citizens' depopulation.

For more information about Tampa flood insurance rates, give Northside Insurance Agency a call at 813-960-5225 today!

(Source:propertycasualty360.com)

No Comments

Post a Comment |

|

Required

|

|

Required (Not Displayed)

|

|

Required

|

All comments are moderated and stripped of HTML.

|

|

|

|

|

|

NOTICE: This blog and website are made available by the publisher for educational and informational purposes only.

It is not be used as a substitute for competent insurance, legal, or tax advice from a licensed professional

in your state. By using this blog site you understand that there is no broker client relationship between

you and the blog and website publisher.

|